Wal-Mart: Why Did It Fail in Germany?

Tuesday, October 30, 2012 at 12:22PM

Tuesday, October 30, 2012 at 12:22PM CEM Strategy Case Study

Wal-Mart in Germany: What Failed?

Case information drawn primarily from Why Did Wal-Mart Fail in Germany (so far)?, Knorr, Andreas and Andreas Arndt, University of Bremen, Department of Business Studies and Economies, Institute of World Economics and International Management.

Wal-Mart’s rise as a retailer is historic. From its first store opening in 1962, it has become the largest private-sector employer in the world, with 1.38 million people on its payroll. Its revenues outstrip General Motors and Exxon. It built this powerful position by promising everyday low prices (EDLP), which it delivered using powerful supply chain integration and automation systems, even forcing its suppliers to change their systems and holding Wal-Mart inventory in their warehouses – and on their accounting books.

Internationally, Wal-Mart’s success has been greatest in Mexico and Canada. But its track record in Indonesia includes serious losses. A few of its outlets in Asia, including China, are profitable, but it has been struggling. Its experience in Germany, however, has been a “fiasco”, according to analysts. In fact, Wal-Mart has left the German market, despite the unprecedented resources it can bring to bear, including:

- Arguably the leading inventory management and logistics system in the world, which tracks more data than any other civilian database

- The world’s biggest private satellite system, used to track sales, replenish inventories and process payments

- Revenues three times higher than its next competitor, Carrefour. These revenues are equivalent to those of Germany’s top 30 retailers, combined.

Entering the market

Wal-Mart built its presence in Germany through acquisitions, buying 85 stores for about 2 billion Euros over the course of 1998-1999. These acquisitions made Wal-Mart the fourth largest hypermarket operator in Germany. Nevertheless, its turnover only represented 1.1 percent of the market. And while its non-food sales were profitable, it overall was accumulating losses, which at one point exceeded $1 billion Euros. It was so cash poor it could not move quickly to refurbish the stores it bought, and even had to close two big stores and lay off 1,000 staff members.

The customer and the competitors

Wal-Mart’s success depends on customers. Who were they and what was Wal-Mart offering them?

Customers had three key characteristics: first, they purchased only a small amount of goods on each purchase. Second, they were not very mobile – which makes sense given the cost of transportation in Europe. Third, they were uninformed about the availability, quality and price of products of the retailers in their vicinity.

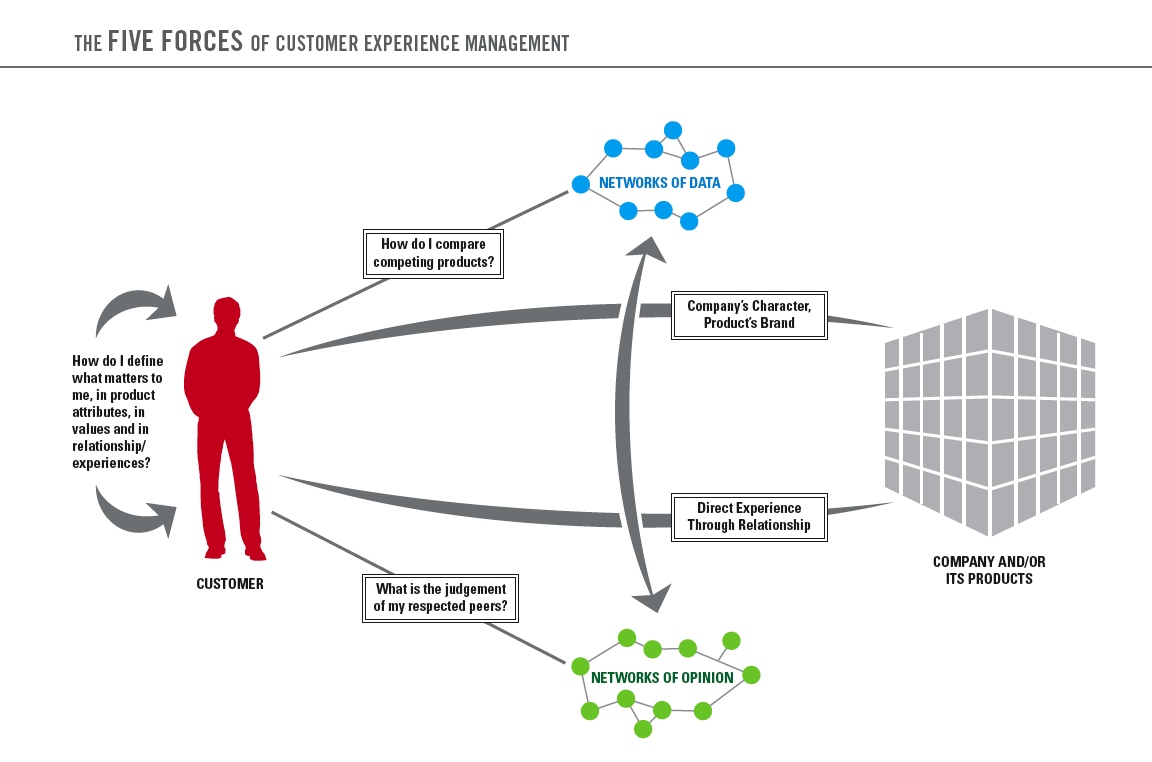

The five forces of customer experience management (Copyright (c) 2004-2012, pkward.com) create a framework for measurement and management. Economic value can be created and destroyed along these dimensions, according to substantial research in consumer styles, reputation management, brand metrics, perceived customer value, and social media.

Target customers in Germany typically wanted lower prices, an accessible or nearby location, superior product selection and superior customer service. In general, they prefer price and value to service and quality. McKinsey surveyed German consumers and learned that price-sensitive customers constitute 42 percent of the market, while only 13 percent cared more about service and quality. Brands matter to 45 percent of the population, as do the preferences of a consumer’s peer group.

Competitors, both local and foreign, succeeded in retail markets internationally by following a straightforward formula:

- Grow by acquisition

- Rely on differentiating the store’s offerings

- Tune core strengths such as logistics or product ranges to fit local preferences

- Keep local managers in charge to leverage their knowledge of the customers and the culture

Consolidation of retail competitors in Germany now is such that the top five retailers control 63 percent of the market, and the top ten control 84 percent. This concentration of sales has led these companies to introduce their own brands in many cases, allowing them some relief from price competition and given them the ability to shift their pricing offerings to remain competitive. Hard discounters offer 600 to 700 products, with very low margins, including food products. In fact, these merchants in Germany control over three times more of the food market than in the UK, and four times more than in France.

Such competition and product range hasn’t left much room for Wal-Mart to compete. Even when Wal-Mart slashed prices as a loss leader to encourage store traffic, it was surprised to see many of its competitors matching its low – even loss-inducing – prices.

Strategy and Failure

- Wrong acquisition strategy: Wal-Mart bought run-down stores from Spar and did not substantially improve them

- Poor merger management (four CEOs in four years) drove away the best store and regional managers

- Wal-Mart in the United States employs virtually no union employees (12 out of 1 million employees are union), so it had no financial or cultural experience in handling layoffs – it even engaged in “union bashing” in the German press when describing its problems in Germany, which created terrible public relations in a country that has long integrated union and management cultures across most sectors

- Wal-Mart in the United States carries notorious influence with its suppliers, but when it demanded unlimited access to its suppliers’ facilities, the vast majority of the suppliers refused to supply this access.

- It could not regularly win price battles, eliminating the credibility of its “everyday low price” guarantee

- Its customer service was regularly rated below average – in part because it had trained its employees in US-style service: within three meters, a Wal-Mart employee was required to greet shoppers, which felt to Germans like harassment, generating actual complaints

- To provide US-style service, it had too many service personnel in the store, far more than Germans expected or needed, keeping the store’s costs simply too high to compete

- Violations of German regulations led to poor PR

Your Conclusions

Which of the following characteristics were most responsible for Wal-Mart’s failure in Germany?

- Everyday low price guarantee not credible

- Everyday low price guarantee not relevant

- Distant locations

- Culturally inappropriate customer service

- Unattractive stores

If you were to guess, how would Wal-Mart rate on these issues?

- Word-of-mouth regarding Wal-Mart in Germany

- Reports in news and online media

- Perception of the company’s character and values

Finally, which of these two issues do you believe was more relevant to Wal-Mart’s failure in Germany?

- The customer experience strategy

- The profitability strategy

Additional discussion questions

Does a profitability strategy for any company exist without a customer experience strategy?

Name sectors where a differentiated, attractive customer experience is highly relevant, and where it is less relevant.

Name two examples where a company in a sector where customer experience had been viewed as less relevant decided to innovate, and succeeded to win marketshare and/or profits beyond their peer benchmarks.

Apply Porter's Five Forces and a resource-based strategic view of the firm to this case study. How explanatory are they? How does customer experience management fit, or not, with these other frameworks? If you treat "customers" as stakeholders, how do the government, unions, suppliers, and the press fit into CEM? Look in particular at the cognitive/affective/conative and behavioral psychological elements of CEM for each of these stakeholders. Which of these stakeholder groups are most rational? Least rational? Which use emotion in their communications and interactions, potentially as a strategic resource of their own?

---

1 A study intended to confirm for German consumers the Sproles/Kendall consumer styles index, originally formulated for US consumers, showed that six of the main drivers were confirmed, while two were not, including the value driver (i.e., low price). Variety-seeking seemed more relevant to German consumers than low prices. See German Consumer Decision-Making Styles, Walsh, Mitchell, & Hennig-Thurau, 2001, p. 73.

Reader Comments