will social media change the banking experience?

Sunday, November 4, 2012 at 9:51AM

Sunday, November 4, 2012 at 9:51AM Consumer perceptions of the banking industry have shifted from being a stalwart institution backed by the government to a fee-hungry, profit-driven, risky sector more eager to “monetize the customer” than provide a secure, sophisticated service provider.

And this didn’t happen with the financial crisis. The shift in trust happened a lot earlier.

Most people trust other people (more than they trust companies or banks, for sure). It would make sense for banks to examine how to incorporate social strategies into their marketing to leverage a social network’s trustworthiness. After all, you may not trust Bank of America, but since twenty of your office workers and best friends do, perhaps you’ll give BofA a chance to be your bank.

Or so the conventional wisdom among Social CRM folks might go.

Frankly, the Social CRM contingent usually overplays its hand, or rather, it thinks in terms of lingo and tools, with which it stitches together a pat but difficult-to-execute solution to trust-building in the banking sector.

One commenter, Jay Deragon, said on the blog, The Relationship Economy: “Banks could set up a ‘social network’ exclusively for banking customers to create profiles about who they are and what they do as well as a listing of their products and services. Banks could establish a ‘community’ for customers to integrate their social media which would create a ‘digital marketplace’ of conversations.” Mr. Deragon was nice enough to put his buzzwords in quotation marks to make sure we didn’t miss them.

Sadly, these buzzwords have become disconnected from their underlying realities. You cannot have a social network without a group of people you want to get to know, whose values you share, with whom you can regularly interact, and who, over time, prove their trustworthiness. A social network emerges from interactions with people you are likely to want to get to know.

A key component of the real social network is the strength of non-directed communications. If everything ever posted on a social network remained focused on only one topic, it’s not a social network, it’s a user forum.

Certainly a social network is not a software platform. You cannot just launch a piece of software and call it a social network. It requires an underlying reality to be created from the people who show up.

A “community for customers” is also an interesting phrase that I think fails the utility test for banks. Frankly, as long as customers define themselves as customers, they are framing any online communications in the transactional aspect of their relationship to a bank. I’m reminded of an early critique of CRM: Why is it, really, that a customer would seek out a relationship with a company? Don’t people just want to interact with companies to the extent that it’s useful to facilitate a sale?

We don’t do ourselves any favors by glibly shifting from CRM to Social CRM unless we get at the heart of what relationships mean and how people interact socially. We’ve compounded the problem.

And the lure of “digital marketplace” is equally odd. The real value of a digital marketplace is speeding up finding the right purchases at a good price. Google is the biggest digital marketplace there is.

If you go to a bank’s site and look over their products, compare investment returns, investigate fees, and look up where branches and automatic teller machines are located, do you think that makes the bank’s site a “digital marketplace” where you are magically going to avail yourself of a bank’s services without visiting Google to compare all this information? Will you ignore the advice of friends or even of strangers and instead prefer a bank’s “digital marketplace” to your own thinking?

Ultimately, this concept fails to inspire any strategist really focused on answering the question: How can banks be trusted again?

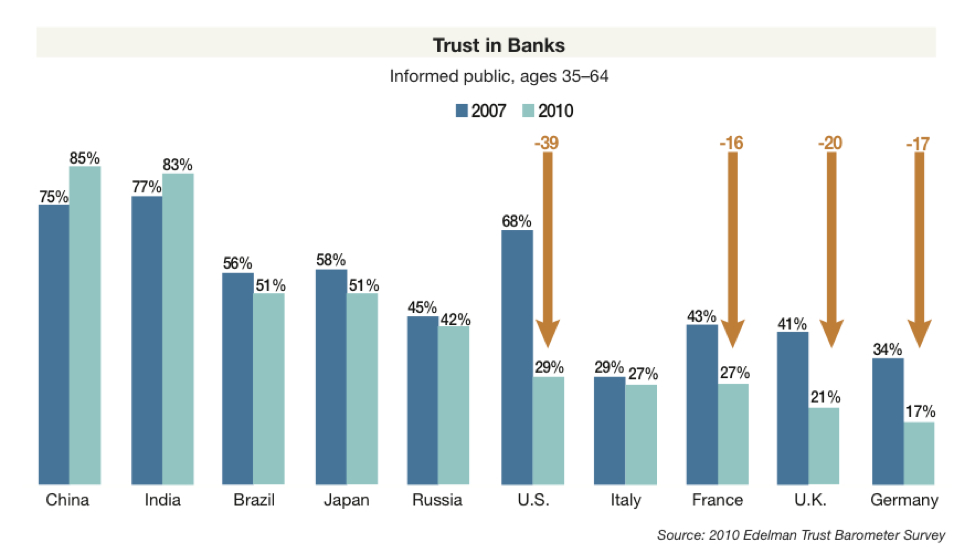

The nature of trust, and customer experience managementThe global economic meltdown has taken its toll on people’s trust in banking worldwide. Edelman’s reporting on the topic shows that trust in banks has dropped since the crisis, even while trust in companies globally has risen. (Check here for a recent Edelman study on trends in trust for banks, comparing US and UK bank brand trust levels. The US is rebounding a little bit, and the the UK has dropped, but the trust levels are still extremely low).

When someone wants to learn about a company, the most trusted sources are stock analyst reports and articles in business magazines, trumping conversations with employees, newspaper articles, or social networking sites. The reason is that these sources are specialized. Academics (64%), experts, and analysts (52%) are trusted more often than “people like yourself” (44%), according to Edelman’s executive summary. In my framework, the five forces of customer experience management, networks of data and networks of people are two sources most highly trusted in the customer ecosystem. And people with access to data invisible to you can be doubly trusted.

In particular, in banking, you need specialized advice if you’re going to make up for any losses you suffered in the last three years. “Trust in banks in the last three years has plummeted,” says Edelman, falling from the third most trusted to the ninth most trusted sector in the United States.

Even if you didn’t lose anything, you may feel lucky you escaped the downturn and, in the context of our times, you may well want ensure you make the right decisions in the future. The last thing you’ll trust is the bank’s advertising, according to studies -- and “social networks” are just barely above that, according to Edelman’s analysis.

Of course, I’ve just made the argument that “social networks” aren’t just pieces of software. The deeper reality remains: Will you trust a network of people who know more than you do? Who can give you just-in-time advice? Who are always there for you? In short, is a real social network valuable to you?

If people don’t trust banks, then don’t be (just) a bank

Banks need to borrow trust from somewhere right now. The best place to find that trust is in the institutions and relationships that their local customers trust. Most banking is still largely local, so look for local "trust resources".

The key is to transform the customer’s perception of your bank, to make it a player within a trusted and trust-building community.

In fact, a bank must do so, because this is the normal evolution of business today. The bank’s imperative is to adopt “transformational leaders” with the goal of enhancing its brand. In short, a bank must become a trusted brand in a community, in which its role is demonstrably transformational.

The study titled Impact of Corporate Social Responsibility and Transformational Leadership on Brand Community: An Experimental Study (Chaudhry/Krishnan, Global Business Review, 2007), posits:

“A brand community, like other communities, is characterized by qualities like shared consciousness (we-ness among members), rituals and traditions, and sense of moral responsibility (Muniz and O’Guinn 2001). Transformational leadership transforms followers’ self-interest into collective concerns and engages the full person of the follower... [T]ransformational leadership is moral in that it raises the level of human conduct and ethical aspiration of both leader and follower”.

Furthermore, the study states, “Transformational leadership offers a solution to the above problem as it has been linked to the implementation of large-scale innovation programs.” On social responsibility, the study concludes, “it shows that corporate social responsibility is becoming more of a necessity by the day. It is very important to the way the firm is perceived by the customers, and becomes all the more important to firms facing stiff competition.”

While companies in general might embrace a “triple bottom line” strategy for positioning themselves relative to competitors, banks in particular must urgently adopt the trend. They’ve flouted good sense -- and possibly the law in some cases -- by behaving in risky and irresponsible ways.

But this is not just about compensating for skirting good judgment and regulations. Chaudhry/Krishnan continues: “There are a couple of things, which need to be mentioned about corporate social responsibility. First, corporate social responsibility is not just about abiding by law but extends to ethical and volitional activities of the firm as well. Even though discretionary responsibilities are left to the businesses’ judgment and choice, social expectations do exist for businesses to assume greater responsibility over and above the explicit ones.” The customer ecosystem brings expectations about banks’ behaviors in general, and it is only within a community response managed by the bank that it can take control of that conversation.

A society of networks

Embedding a bank in a community may not seem like news, given the concept of “community banking”, but building a community in the Internet age has two key components: a local strategy (because people really do build trust when they’re physically together), and the ability to create a “society of networks” groups of businesses and people that are broadly aligned with the business’ vision (not necessarily just to make it profitable, per se).

In Heading Toward a Society of Networks (Journal of Management Inquiry, 2009), the authors, Jörg Raab and Patrick Kenis, define such societies of networks as, “consciously created groups of three or more autonomous but interdependent organizations that strive to achieve a common goal and jointly produce an output.”

For financial services firms, the questions to answer are:

- Whom do we invite to join our network? These participants should either convey trust to customers already, or be able to create trust within the network.

- How do we handle the participants and their customers/stakeholders, particularly relative to operations, regulatory requirements, and sales/marketing?

- Is it open (essentially the same question as, “Does it cost nothing to enter or leave the network?)

- How does it create value for participants?

- How does it advance the values of participants and their customers/stakeholders?

- How do all these answers define “who are we as a network”?

I have advised banks in the past to create a social network in which businesses close by, or well known to, a customer contribute to a body of knowledge about business success. This topic is about financial management - which is precisely what the bank wants you to think about. Credit, loans, savings, insurance - all these products contribute to the outcome of business success. (For more insight, do a Google search on outcome-based marketing.)

Even if a customer is not in business in the normal sense, he or shee will see the parallels between managing a business and managing personal lives - and they will see that a local bank is helping everyone to succeed.

In a “society of networks”, such businesses become networks of their own, with their own customers and prospects being drawn into the conversation - but the overall society has greater value than any individual network could create on its own. The local strategy is to get the bank’s customers and prospects to see that the bank is serving “Main Street” - they are concerned about the success of the restaurants, drug stores, flower shops, and dry cleaners that you see every day.

Extending the brand boundary, but creating exclusivity

The challenge in creating a society of networks relates to the bank’s brand. Where does it begin and end? What promises can it make, and which “implied” promises in the society of networks is it making about which it should be aware? Such explicit and implied promises may introduce legal and regulatory issues. And such fuzziness may also make the brand cloudy, particularly if the philosophy of the platform is to welcome individuals in the community who may also have an agenda in opposition to the bank’s brand and reputation.

But that risk may be worth it. The alternative is a tightly bounded network that doesn’t permit the bank to invite new people to see that it is a trustworthy, transformational leader of the community.

Still, boundaries - in the sense of values and “membership” responsibilities - are critical. Raab/Kenis, again in Heading Toward a Society of Networks, comment broadly:

“[If] one asks ‘who are we as a network,’ it is implicitly assumed that it is clear, who or what ‘we’ is, i.e. a social entity that is bounded. Therefore, identity formation can only take place on the basis of inclusion. This in turn means that there must also be exclusion, i.e. a definition of who or what does not belong to the social entity. The development of ‘network for itself’ thus goes to a certain degree against the notion of high connectedness emphasized in the network society but rather re-emphasize the notion of inclusion and exclusion. As a consequence, bounding the social system is (again) of central concern, although as we argue below, boundaries very often remain flexible and fluid for whole networks.”

A bounded society of networks has identity - a kind of meta-brand - and in that meta-brand the bank can borrow the community’s trust to restore its position. When a person leaves that community, it stands to lose a lot of information, connection, and utility. This creates a switching cost that is real, even though it is largely psychological. Switching away from such a network would cause a participant some stress, because it is filled with people and companies they trust. Including - and potentially at the center - a bank with a local branch not far from where person lives. They just won’t want to end that relationship.

And that’s exactly what banks need right now.

Reader Comments