Effective In-Store Experience

With all the buzz around e-business, it still remains a small part of overall worldwide transactions. Only 22 percent of the world is online, and many of those cannot reasonably conduct business given their age, their economic situation and their local infrastructure – not to mention preferences! Even in the United States, the most connected country in the world with more than seventy percent of its population online, online retail sales were not even three percent of total retail volume.

Brick-and-mortar retail drives economies. Given that customer experience management (CEM) when done correctly pulls levers in people's hearts and minds to create satisfaction, improve word-of-mouth and instill loyalty, the potential impact of good CEM for generating profit is enormous.

In a tough economy, when traditional corporate communications are both distrusted and increasingly focused on profit-stealing “bargains”, CEM can be a better investment than demand-generating investments such as advertising. If a big box store spends millions trying to convince customers they care, the investment can be completely undermined if the sidewalk in front of the store is littered with trash, has grass growing up in cracks, and is cluttered with shopping carts.

Add to this the brand destruction flowing from surly clerks and poor service recovery when customers complain, and retailers will see that a shift towards CEM investments could well be the right approach to competing better in challenging economic times.

The principles of good CEM are easy to grasp, and while it is always better to implement more of them, and to do it in a measurable, comprehensive way, just a few beginning steps towards creating effective in-store experiences can have an impact for retailers seeking differentiation, loyalty and positive brand equity.

It Started with Disney

Michael Lingerfelt, vice president of architecture and design for McGillivray Consulting Group, is one of the nation's leading retail architects. We worked together when I was leading strategy engagement for the American Institute of Architects, for which we were designing a knowledge management capability at AIA for retail architects. At the time he was the director of project architecture and engineering at Walt Disney Imagineering.

“Before 1955,” Michael tells me, “all big retailing looked like K-Mart. You had a warehouse, 'blue light' type specials.” And what happened in 1955? “Disneyland opened,” he said.

And so, in a way, themed retailing came from Walt Disney (“Walt,” as Michael still calls him). It was the beginning of customer experience management, because themes create value in the minds and hearts of customers by stimulating senses, evoking emotions, and setting people in an environment where stories come to life.

It's no surprise that Disney's innovations are still touted today in customer experience management books in the popular business press, and even consumers instinctively understand what Disney was going for: embedding the buying experience in stories, myths and common needs. In this context, buying is an expression of identity that fulfills emotional and spiritual needs.

“First and foremost,” Michael says, “you have to remember that retail is an emotional experience. It solves a problem that has emotional components.” What are the key drivers of retail success in customer experience terms? Michael refers me to a guide to amusement park design devised by Marty Sklar (his former boss at Disney). Mr. Sklar called them Mickey's 10 Commandments. Michael can recite them from memory, which gives you a sense of the power of Disney's culture. They all map well into core customer experience management principles.

- Know your audience

- Wear your guest's shoes

- Organize the flow of people and ideas

- Create visual icons

- Communicate with visual literacy

- Avoid overload

- Tell one story at a time

- Avoid contradiction

- For every ounce of treatment, provide a ton of fun

- Keep it up

While these might seem prescriptive, even simplistic, they capture the fundamental insight of customer experience management: Brands drive business success, and they are created in the mind. A consequence of this insight is that companies must learn how customers think, feel, and remember before they can create sustainable business value. Applying customer knowledge across channels, and improving that knowledge over time, is what makes customer experience management a science.

Managing Retail Experiences

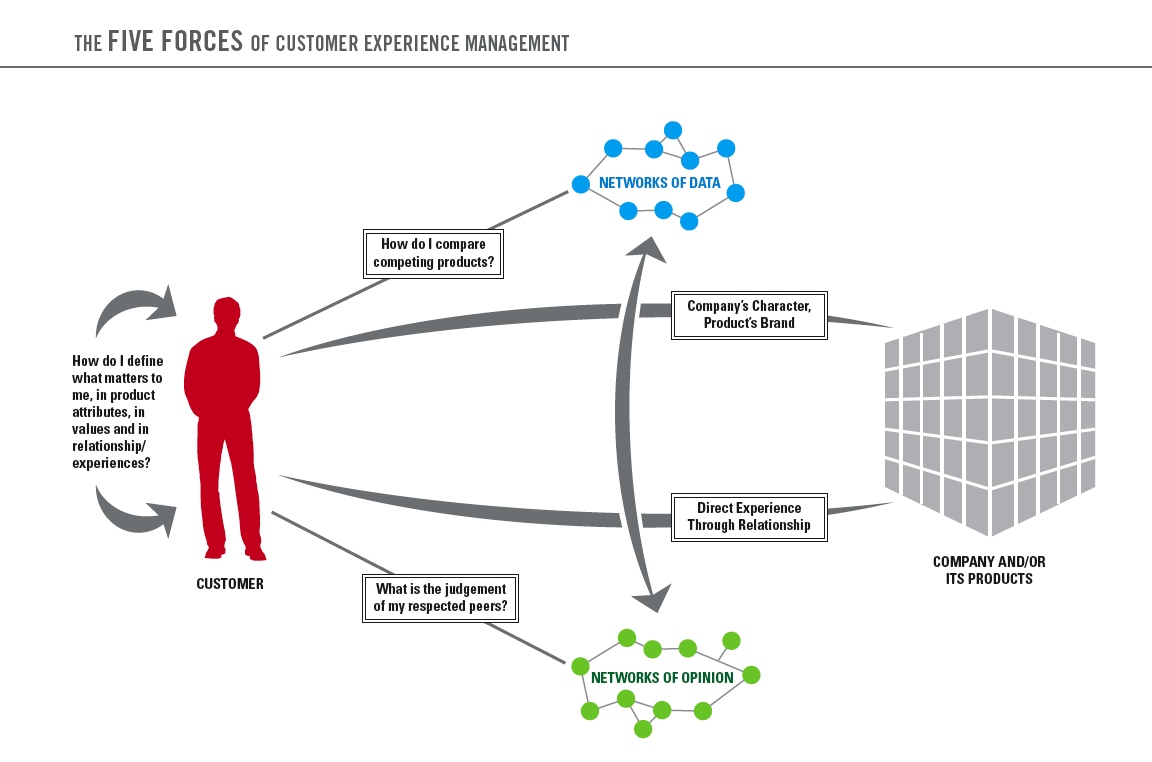

In the growing field of customer experience management, a key challenge is to create methodologies that work in as many customer channels and scenarios as possible. This approach lets companies be systematically sensitive to customer demands, instead of putting out fires at the call center or the returns counter.

CEM methodologies go beyond merchandising experiences within a store, or how to theme displays. CEM must accommodate the interplay among channels, and measure the effectiveness of cross-channel processes and designs. When a prospect or customer walks into your shop, they've had their expectations set by your advertising, your website, and their past experiences with your customer service representatives. Your brand – and their loyalty to it – depends on how well you manage expectations every time they interact with you.

CEM differs from the way past customer management specialties work. For example, customer relationship management as it is normally practiced normally does not directly address the fundamental CRM question: Why on earth would a customer even want a relationship with your company? CRM systems normally do well at automating sales processes and measuring customer satisfaction, but that's hardly the kind of approach that guarantees the kind of customer engagement that generates consistent profits from loyalty and word-of-mouth marketing.

Similarly, customer value management, even when combined with predictive analytics based on loyal customer behavior, usually is so focused on transactional data and financial metrics that it becomes easy for a company to become obsessed with their own customers behaviors instead of their target market's aspirations, organizing values and emotional needs.

Walt Disney would definitely not approve.

So, what makes CEM different – and better – than traditional approaches to retail? While studying store traffic, shelf use and exterior design will always matter, CEM embeds these traditional retail strategies into a larger framework. Let's take a look at two key components to a CEM retail strategy: metrics and segmentation.

You cannot manage what you do not measure.

A good retail CEM strategy starts with the right measures. Fundamentally, CEM is about creating a branded, differentiated impression that results in a memory that serves the customer and your business. Memories don't have to be “good” ones – you can interact with an aloof service representative at a Prada store, and the moment will be branded to the point where you actually desire Prada more. But an aloof service representative at Nordstrom will annoy you, risk a sale and possibly generate some bad word-of-mouth.

These examples reveal that managing customer experiences is not about ever-improving quality of service. It's about advancing your brand values in the network of customers, prospects and other stakeholders who matter to you. When experiences accomplish this, you have created an effective, branded experience that correlates with profit, good reputation and improved loyalty.

CEM, then, is all about how the brain works to create the right impression. CEM metrics flow from measuring that process and its effects. Key to understanding CEM in the retail environment is the following:

- Who are you targeting?

- How do they value the world? (Look at Myers-Brigg, DISC, and SDI as frameworks)

- How are these values framed in terms of actors, stories and desired outcomes?

- What cultural, psychographic or demographic characteristics matter in the ideal experiences your customers want?

- What traditional merchandising and branding approaches must be reconsidered based on the above questions?

Understanding how people think, what makes them remember something, and how they make decisions of course impacts marketing and communications, but the implications for our new knowledge include a new, more ethical and powerful grounding for marketing and communications theory. In particular, scientists have found that people think in frames that capture story structures, values and meaning in the deepest sense. We organize reality with these frames. They are built into the brain, and therefore into the mind. The consequence for marketing and communications is that every business must successfully answer the question: What meaning are we creating in the marketplace? Are we offering something beyond mere products and services? Are we living out a story in our mission and behaviors that people can truly care about?

These issues map perfectly into Marty Sklar's recommendations about knowing your customers and telling consistent stories, one at a time.

From Minding Things in the Store to Storing Things in the Mind

What makes CEM such a comprehensive approach to customer management science is its focus on how the mind works to create meaning. The mind has in the past been a proper domain of branding professionals, but now understanding the mind is critical to overall organizational design, incentives, and competitive strategy.

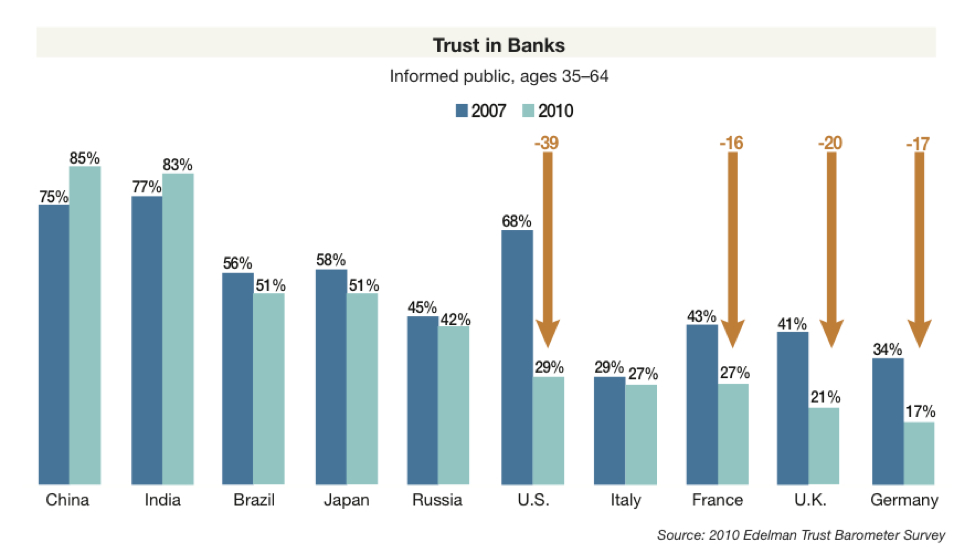

Take a look at retail banking for example. Kathleen Khirallah, research director for TowerGroup, got it half right when she said, "An ongoing source of frustration for customers and bankers alike is the inability of customer contact personnel to interact with customers in a manner that demonstrates knowledge of the customer and their value to the institution.” (Chordiant Software establishes core leadership in retail banking; Leading provider of Customer Experience (Cx) solutions now serves ten of top twenty global banks. M2 Presswire, May 2006.)

Demonstrating knowledge of the customer is critical to the customer's emotional response to the company. The information is useful as well, as it helps the customer service staff person act on the customer's preferences to solve problems, offer the right services, and so on. But it's the emotional response that gives customers a more powerful foundation for memory, and for creating meaning in interactions.

Knowledge of the customer's problems is a leading indicator of satisfaction – it even generates a sense of intimacy. But how do you get from intimacy to satisfaction?

Many customer research firms offer solid research that can help the retailer. Carlson Marketing's framework features trust, commitment (an emotional measure), and a two-way expression of mutuality and alignment. Some studies have shown that mutuality and alignment flow from the extent to which companies and their customers believe they share values, aspirations and desired outcomes. Carlson shows that high scores on their relationship framework are strongly correlated with the behaviors that retailers want: recommendation intention, loyalty and interest in buying more products.

Notice that loyalty – both as an attitude and as a behavior – is now a derivative metrics. The prior, independent variables of trust, commitment and mutuality/alignment are chiefly shaped by emotions. To get from customer knowledge to intimacy requires the design of processes, use of technology and employment of people aligned around trust-building, commitments and a sharing of values, aspirations and outcomes.

Beyond emotion, CEM metrics focus on both memory and story telling. Both of these metrics indicate the extent to which a customer's experiences reinforce a frame used unconsciously in the customer's mind with which they understand, measure and remember value and values.

Frank Capek, a CEM consultant from Atlanta, Georgia, USA, reinforces some key cognitive psychology points (some coming from Daniel Kahneman's groundbreaking work for which he won the Nobel Prize). If you ask people to tell you the last four digits of their Social Security Number (SSN) or phone number, they may subsequently guess the price of a bottle of Cotes du Rhone red wine they've just tasted as high (if the last four of their SSN were high), or low (if the last four digits were low). Of course, consumer decisions are more complex, but the effects Capek describes are real, and must be considered in designing a retail experience. Another topic that Capek discusses is one of my favorite themes in my CEM teaching: storytelling. Capek had worked with a champion high-altitude mountain climber, Christine Boskoff, who wanted to attract more customers to her company, Mountain Madness, which offered outdoor adventure travel. His suggestion? At the end of an adventure, have participants gather around to tell stories.

This is what is sometimes called elaborative rehearsal, which is, in a nutshell, getting people to practice the behaviors you want them to repeat. After rehearsing stories, your customers have already imprinted in their minds the key messages, values and emotions that frame their experience. They're more likely to tell stories – effective and authentic stories – than without such rehearsal.

CEM's point of view on management science, as a result, elevates the customers spiritual, emotional, cultural and other psychic needs to the forefront of process design, environmental design (merchandising, for example), and human resource strategies. Metrics such as speed, efficiency and quality of service – as objective as they sound – in fact are not key performance indicators unless they are correlated with key experience metrics. So, even though Kathleen Khirallah of TowerGroup seems to espouse customer intimacy, she – and many other analysts, continue to provide tactical retail strategies based on the wrong measures. “Customer interactions,” she says, “still fail to meet customer expectations -- for speed, efficiency and quality of service.” Unless by quality of service she is referring to outcomes such as memorability, storytelling, brand reinforcement, and emotional engagement, Ms. Khirallah is still firmly in a pre-CEM management paradigm.

The benefits of measuring the right things in your CEM strategy are plain. Better relationships build more value. Carlson Marketing studies show that a 5 percentage point improvement in their relationship skill improves customer value by 25 percent. Focusing on emotion isn't just a good thing; it must become a core competency of your company.

People Want to Feel Different Things

Segmentation is critical to business success. The more a company such as McDonalds tries to be all things to all people, the more their experience – and differentiation – will converge on an average. (G-CEM's analysis of McDonalds vs Burger King provides some analytical meat to this proposition, and is well worth the study.)

In CEM, segmenting your customers based on desired experience helps you focus on the investments you have to make to generate effective outcomes. If you want to be remembered, if you want to build your brand, and if you want to create real engagement, you cannot offer the same experience to everyone.

Many companies already do this without a formal program. Best customers, regular customers, complainers, friends of the boss – they all get different treatment. But if you segment your customer experiences this way you're not necessarily being strategic for the firm.

Even in CRM, which presumably is more rational about organizing a business's response to a customer based on their value, you will see non-strategic behavior. A classic example is providing discounts to most valuable customers. Companies do this because they feel they can “afford” to do it, and the customer will be “less likely” to bolt to a competitor.

Is that true? Probably not. Recall that a key CEM metric is the extent to which a customer feels understood by a company. In B2C, this is an emotional bond. In B2B, sharing risk and aligning with a customer’s road map prove it. Where do discounts even matter in these cases? Netflix appreciates this and in fact provides worse service to loyal customers – because it can leverage the emotional bond to allow them to ship faster to new customers who are not yet loyal. Thus, Netflix is measuring and acting appropriately within the CEM paradigm. And in the case of Procter & Gamble, their commitment to retailers in their channels is legendary: they want retailers to profit from selling more Procter & Gamble products based on factors such as product placement, assortment, choice – not necessarily discounting.

In CEM, you have to do some serious study to determine which customers are most valuable to you, and what kinds of experiences you want to give them.

Sometimes your customers' experience preferences break down nicely along demographic lines. For example, the IBM Institute for Business Value did a comprehensive study of the differences between how teenagers (teens) and Baby Boomers (boomers) shop (Retail Opportunities in a World of Extremes: Understanding today's teens and boomers. 2006). In the study, IBM looked at the role of shopping for these two groups, what influenced purchases, shopping styles, how technology affected shopping, and the drivers of successful experiences.

As you might expect, for teens, the social network matters. When shopping online, thirty percent of those surveyed use “email to a friend” links, and the vast majority of teenagers respect and follow the advice of friends – and celebrities. Boomers trust brands – and their parents. These trends show how different generations frame authority and trust differently. As a result, teens view the success or failure of an in-store experience as depending on the people. Boomers are less patient. A single bad retail experience means they reject not only the customer service person's behavior, but also the entire store and the brand.

Thus, the moments of truth for these two segments differ dramatically. Just this basic knowledge can help retailers train staff to deal more effectively with service failures, and to even create more positive experiences proactively.

Teens investigate products online, but buy in-person. This suggests one set of cross-channel opportunities, involving social networks, checking for products in-stock, and even embedding your retail experience in the teen's social calendar (buy more than $100, get a free movie ticket at the neighboring theater, for example). Boomers may buy online more often because they have credit cards, but they may want to return or exchange products in person. If that's the case, you will want to design a returns and exchanges process that is fast, respectful and brand-reinforcing. Train the customer service people to be especially aware of signs of frustration for boomers.

Sometimes, however, demographics don't help you much. Some people just have different tastes and shopping styles. This matters tremendously to the success of a retail experience. Wal-Mart customers in Germany notoriously rejected Wal-Mart's cheerful in-store culture. They didn't appreciate Wal-Mart's anti-labor attitudes. And, ultimately, German shopping styles have been shown in various studies to be driven more by variety than by price alone. So Wal-Mart's values, operations, HR training and fundamental offering were wrong for Germany, and it cost the global giant billions of dollars before they closed up shop and left the country.

Setting Your Retail Strategy

The Apple Store doesn't have lines, it has clumps. Instead of waiting to be rung up, customers assemble in groups around computers, phones and iPods, engage in conversations, assisted by an Apple Store employee. When it comes time to make a purchase, the Apple Store employee doesn't guide the customer to a line. He or she brings out from the storage room the customer's purchases along with a mobile wireless device, takes the customer's order, emails the receipt.

Does the customer wait? Yes. But is there a line? Absolutely not – and that's the key. Because the physical characteristics of the purchase experience are different from what customers expect in the retail experience, the Apple store customer never feels like they're waiting pointlessly. It's interactive, friendly, bump-free – all earmarks of a well-conceived, differentiated customer experience.

This is a simple example of how process design and technology can help reconfigure customer perceptions and expectations in ways that matter to them, and that are easy for them to describe in stories to their friends.

Beyond Technology: Embedding Experience in the Brand

It's not just the technology that matters. Sustainable differentiation comes in the brand values that are expressed in your overall processes, and in what makes up those processes (signage, queuing, restrooms, merchandising, environment, and so on). These subprocesses bring technology, people, process and design together to reinforce your brand values.

As innovative as Apple's retail strategy is – and it is surely the most successful of any single-line computer retail operation in history – Lulu Lemon' Athletica's strategy surpasses it. LuluLemon Athletica opened its first store in Vancouver, Canada in 2000. They offer sportswear that leads the industry in quality, design innovation and use of sustainable materials. Their products are expensive and they make no apologies about it. But their real innovation is how they engage their store employees and local organizations, including yoga studios.

Just as Apple claims to be a product company but is instead a customer delight company, LuluLemon Athletica has claimed to focus on offering the highest quality, most innovative yoga and sportswear apparel in the world – but it's really a luxury version of the Southwest Airlines strategy of exploiting their most expensive assets for competitive advantage.

Consider Southwest. Their key strategy is to keep their airplanes in the air. To do this they abandoned the spoke-and-hub model of scheduling flights, instead finding direct routes to allow their planes less downtime. They've eliminated meals, so they don't have to spend time stocking food on each flight. And they let their customers choose their own seats for one reason: people get in their seats faster, which lets the planes get off the ground faster.

Southwest compensate for its lack of food and Wild West seating system by hiring and training the best staff that knows how to make flights fun, creating a customer experience that consistently receives industry-leading customer satisfaction scores. In business terms, their strategy is about improving the income they can make on their planes, boosting their return on assets compared to competitors.

Now look at LuluLemon's use of its key assets. First, it doesn't do what competitors (which include Nike Store) might do: view its assets as its inventory. LuluLemon defines its key assets as its store clerks and “engagement partners” -- primarily local yoga studios. Second, it finds ways to leverage these assets at a very low cost.

In the case of its own staff, that leverage comes from creating a differentiated customer experience by creating a compelling interaction between customers and LuluLemon staff.

LuluLemon's philosophy is that store employees are not clerks. They educate customers, they don't sell to them. Even better, these educators know the products well because they use them. They will show you how to use yoga clothing to do yoga by actually performing yoga moves for you in the store. Assuming that a customer aspires to a yoga-driven lifestyle, this creates the kind of alignment that Carlson's relationship index measures.

LuluLemon's staff obviously must be carefully hired to make sure they live a yoga-driven life as well, but the store takes no chances – it makes sure staff members have a chance to use its products in yoga class, by actually having yoga classes at the stores.

At a local LuluLemon in Bethesda, Maryland (one of three in the Washington DC region), every Sunday night the store closes, employees shove product displays to the side, and a local yoga instructor offers a free yoga class to anyone who wants to show up, free of charge. In Bryant Park in New York, Lulu Lemon has free yoga classes outside. This generates what Carlson's index might call mutuality, as well as commitment: both employees and customers perform yoga side-by-side, showing that they have mutual interests, and dedication, to the yoga-driven life.

In terms of return on assets, all this exemplary marketing takes place in a fixed-cost facility, with employees “off the clock”. With no additional expenditure, a surprising amount of customer equity is built – even if customers never act on the knowledge that LuluLemon offers free yoga. It's the offer that counts in reinforcing the customer's perception of commitment, mutuality and alignment.

When it comes to “engagement partners”, LuluLemon has also turned local yoga studios into customer channels using a classic win/win formulation: the studios can teach free classes at LuluLemon to win students, and the LuluLemon store can win lifestyle customers.

As a side benefit to this strategy, it is likely that staff stay with the company longer, reducing the costs of employee churn. Compared to Nike Store staff, LuluLemon educators are probably more effective in selling products – even the expensive line that LuluLemon features.

So, while Apple Store employees may be equally enthusiastic and knowledgeable about the products they sell, it is LuluLemon that is leveraging its staff, facilities and yoga studio partners to create community engagement, to prove the value and values of the brand, and to show that LuluLemon lives up to its claim to be about fitness and wellness. The products, the people and the stores are all aligned around making those claims memorable, branded, and positive.

Experience matters so much for LuluLemon that they've reinvented the whole concept of the retail store. They aren't selling products on racks. They're selling you on an idea: You can have the health and happiness you seek. For Nike, “just do it” is a slogan. For LuluLemon, all across North America – even after hours – people come together to truly just do it.

Conclusion

Companies like Escalate Retail have helped Brooks Brothers win retailing awards for their cross channel customer experience, leveraging customer insight. Yantra, a Boston, Massachusetts vendor of supply chain informatics, offers visibility in the supply chain to help retailers fulfill orders.

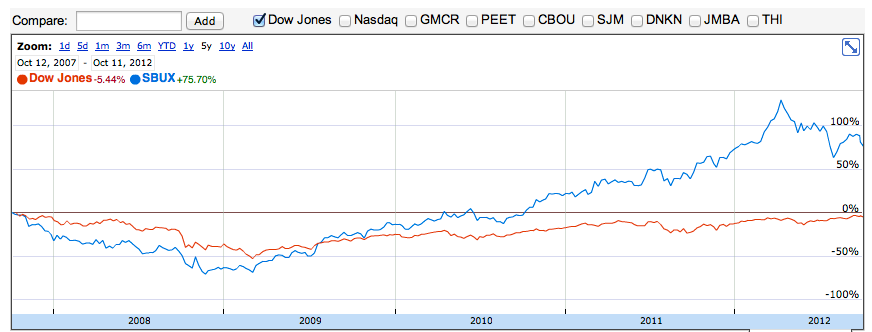

But these suppliers only solve part of the problems faced by retailers. Better supply chains help. More customer information helps. But in the end, the goal for any retail operation is to create an effective experience, and it cannot be effective unless it is branded, remembered, and meaningful. Apple continues to polish its image and ring up profits in its stores, even when online retailers such as MacMall offer steep discounts. Why? Because the experience matters.

My colleague Michael Lingerfelt has moved on from Disney, now working for a global retail design firm. His current project is a themed experience that evokes Paris, one of the most emotionally evocative places in the world. Even today his enthusiasm for creating emotionally inspiring customer experiences is real. He talks about “Walt,” recites statistics on how long trash stays on the ground in a Disney park (about 23 seconds), and passionately recites Marty Sklar’s ten commandments.

Stores like LuluLemon understand that an authentically great customer experience needs to be as much in their culture as it is in Disney's. Its business trade-offs are driven by this passion. In fact, LuluLemon doesn't even offer its clothes online. You can get the full experience through that channel – and, after all, online retail is still only a drop in the bucket. Our economy is built on bricks, held together by mortar – and increasingly by the kind of retail passion exemplified by LuluLemon.

With innovative customer experience strategies, designs, processes, technologies and training, retail customers can have their brains lighted up exactly the way you want them to be. Your brand will trigger mental fireworks, different customers will enjoy you in different ways, and they will keep coming back, willing to pay fair prices, and ready to say good things about you to their friends. In a down economy, that's what retailers could really use. So before you rush into discounting, start planning how to craft a terrific customer experience. Then just do it. And, as Michael Lingerfelt, Marty Sklar, and surely Walt Disney would urge you, keep it up.

Sunday, August 18, 2013 at 8:32PM

Sunday, August 18, 2013 at 8:32PM